Step 2: Next, determine the fixed costs of production, which include those types of costs that are periodic in nature and, as such, do not change with the change in the production level. Examples of variable costs are raw materials, fuel, direct labor, etc. Typically, variable costs directly vary with the change in production level or sales volume. Step 1: Firstly, determine the subject company’s variable production costs. To derive the formula for break-even sales, you can follow these steps: Source: Walmart Annual Reports (Investor Relations) Explanation Calculate the break-even sales of ASD Ltd. On the other hand, periodic costs such as depreciation, taxes, and interest expenses stood at $100,000, $50,000, and $200,500, respectively. The company incurred a raw material cost of $2,500,000 and a direct labor cost of $1,500,000. engaged in pizza selling that generated sales of $5,000,000 during the year. Let us take the example of another company, ASD Ltd. Therefore, the company has to achieve minimum sales of $1.43 million to break even at the current mix of fixed and variable costs. The calculation of break-even sales is performed using the following formula:īreak-Even Sales = Fixed Costs * Sales / (Sales – Variable Costs) Calculate the break-even sales for the company if the fixed cost incurred during the year stood at $500,000. According to the cost accountant, last year, the total variable costs incurred added up to $1,300,000 on a sales revenue of $2,000,000. Let us take the example of a company that is engaged in the business of leather shoe manufacturing.

BREAK EVEN POINT FORMULA IN DOLLARS PER PERIOD DOWNLOAD

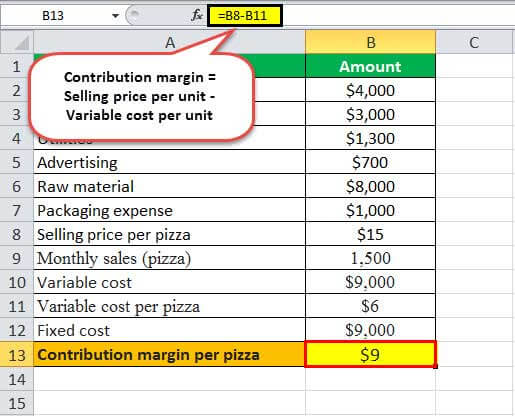

You can download this Break-Even Sales Formula Excel Template here – Break-Even Sales Formula Excel Template Break-Even Sales Formula – Example #1

0 kommentar(er)

0 kommentar(er)